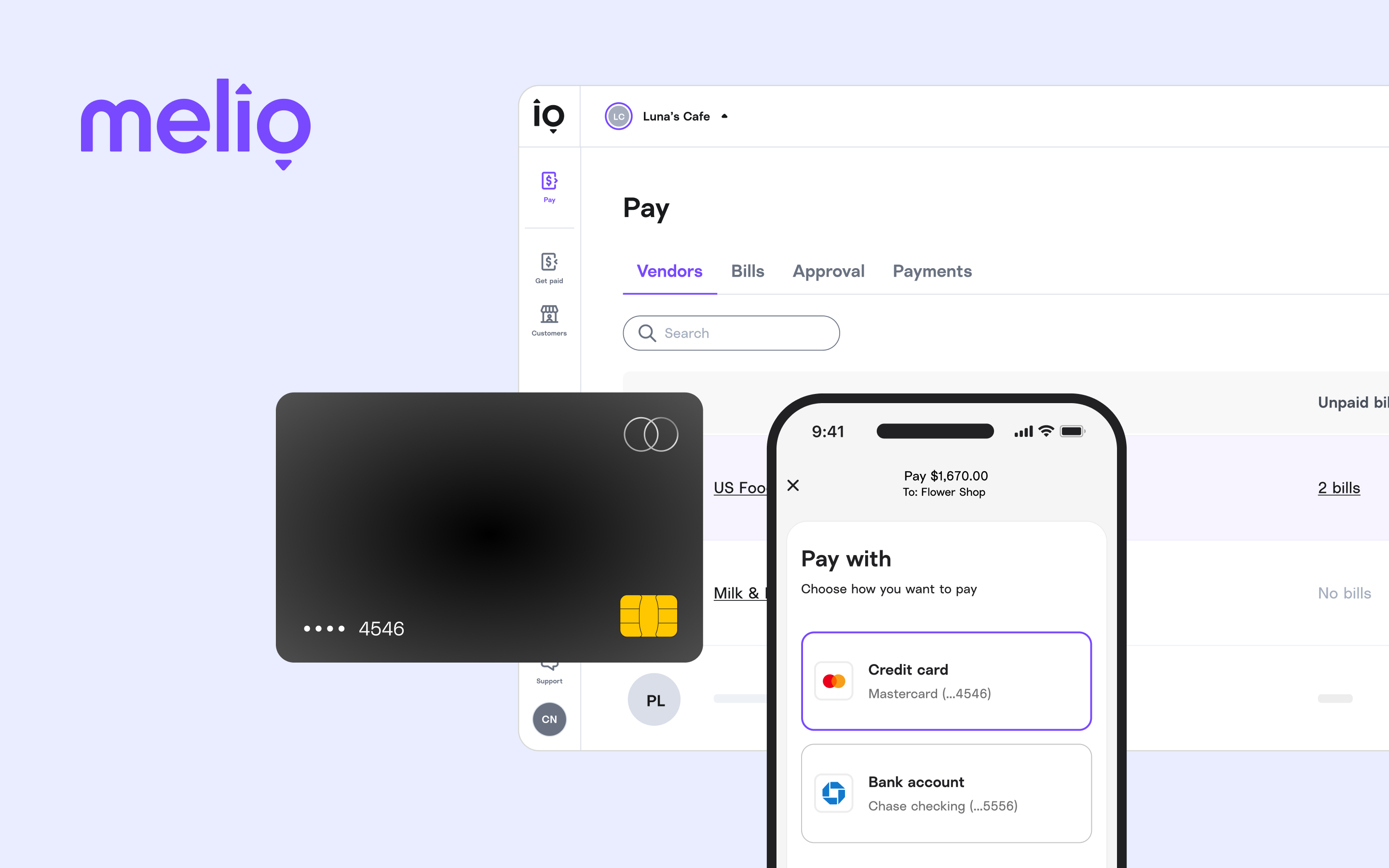

As a business owner, staying on top of bills, payments, and managing cash flow is essential. That’s why I decided to try out Melio, an online B2B payment solution that has taken a lot of stress out of paying vendors and contractors. After using Melio for several months, I can confidently say it’s a tool that every small to medium-sized business (SMB) should consider. Here’s why.

What Is Melio Payments?

Melio is a business-to-business (B2B) online payment platform designed to simplify and streamline the accounts payable process. You can use Melio to pay vendors, contractors, or any other business-related expenses, even if your vendors prefer paper checks or ACH transfers. It’s a perfect solution for business owners who want to manage payments digitally without getting bogged down by unnecessary complexities.

Unlike other payment services, Melio focuses on flexibility and no hidden fees—which is a game-changer when you’re dealing with tight cash flow. You can pay with a credit card, debit card, or through ACH transfers. Best of all, ACH payments are completely free. This is incredibly appealing for businesses that want to maintain cash flow while earning credit card rewards.

Why I Switched to Melio

I had been using traditional methods of paying my vendors—mainly checks and manual ACH transfers. The process was time-consuming, prone to error, and honestly, outdated. I started looking for a payment platform that could speed things up without adding complexity or high fees, and that’s when I found Melio .

Free ACH Payments

What really drew me in was the fact that ACH payments are free. Unlike other services that charge for ACH transfers, Melio lets you send ACH payments at no cost. I was paying a small fee per transaction with my previous provider, so this was a no-brainer. It’s especially useful when you need to make multiple payments in a month.

Pay Vendors the Way They Want

Another standout feature is that Melio allows vendors to choose how they want to get paid. If your vendor prefers to get paid by check, you can schedule that, and Melio will mail it for you. If they prefer ACH or wire transfers, you can facilitate that as well—all from one dashboard. This flexibility has helped me keep good relationships with my contractors and vendors because I’m not forcing them into one specific payment method.

How Melio Improved My Business Operations

Streamlined Accounts Payable

Before Melio, managing my accounts payable was like juggling fire. There were late payments, missed deadlines, and a general sense of chaos. Melio has eliminated that. The platform allows me to schedule payments in advance and keep track of what’s coming up. I can see, at a glance, all of my pending payments, which makes it easier to plan my finances.

Improved Cash Flow Management

Another key benefit I’ve experienced is improved cash flow management. With Melio, I can use my credit card to pay bills—even if the vendor doesn’t accept cards. Melio pays the vendor in their preferred method (ACH or check), while I get to pay via my credit card and benefit from extended payment terms and rewards points.

The best part? Melio allows you to schedule payments so that the funds leave your account at the perfect time. If you’re a little low on cash one week but expect to get paid the next, you can delay the payment to keep your cash flow in balance. This feature alone has saved me more times than I can count!

Features that Set Melio Apart

$0 Fees on ACH Payments

The $0 fee on ACH payments was the feature that first caught my attention. In today’s world, it’s rare to find a service that doesn’t come with some hidden charges. With Melio, there are truly no fees for ACH transfers. This is perfect if you’re making a high volume of payments every month or working on a tight budget.

Same Day Card-to-ACH Transfers

One of the newest features I’ve been using is the same-day card-to-ACH transfer. This allows me to pay my vendors quickly while earning credit card rewards. It’s a win-win for both me and my vendors. Plus, the same-day processing ensures that urgent payments are never delayed.

No Monthly Fees or Subscriptions

What I really love about Melio is that there are no monthly fees or subscription costs. You only pay for what you use, and in many cases, you may not pay anything at all. For instance, if you exclusively use ACH transfers, your costs with Melio will remain at $0.

Pay Any Contractor Online

Melio allows you to pay any contractor online. Whether your contractor wants a direct ACH transfer or a paper check, Melio can accommodate their preferences. I’ve even used it to pay some smaller contractors who prefer paper checks. All I need is their email or contact information, and Melio takes care of the rest. The vendor gets a notification, and I’m done. No more printing checks or making unnecessary trips to the post office.

Who Should Use Melio?

Melio is perfect for any small to medium-sized business that handles frequent vendor payments, especially those in industries like:

- Construction

- Freelance

- Marketing and Advertising

- Retail

- Real Estate

If you want to simplify your accounts payable process while keeping things flexible for your vendors, Melio is a great fit. It’s designed to handle the complexity of B2B payments without burdening you with high fees or difficult-to-understand processes.

Personal Experience with Melio

Switching to Melio has significantly streamlined how I manage payments. From automating vendor payments to earning credit card rewards while paying bills, the platform has transformed what used to be a cumbersome process into something simple and efficient.

I’ve also found their customer service to be extremely responsive. Anytime I’ve had a question, their support team has been quick to respond with helpful answers, making the transition to their platform smooth and worry-free.

How to Get Started with Melio

Getting started with Melio is quick and easy. It only takes a few minutes to sign up for a free account. There are no upfront costs, and you can immediately begin setting up payments for your vendors and contractors. Once you’re in, the platform is very intuitive, and you can start making payments right away.

Melio also integrates with other accounting tools like QuickBooks, so if you’re already using that software, it’s incredibly easy to sync everything up. This makes managing your books and payments even more straightforward.

Conclusion: Why Melio is the Best Payment Solution for Your Business

Melio has genuinely made a difference in how I manage my business’s finances. It’s free, flexible, and most importantly, easy to use. Whether you’re paying via ACH, credit card, or debit card, Melio offers a solution that works for both you and your vendors.

For any business owner struggling with the complexities of accounts payable, Melio is an absolute must-try. It’s more than just a payment platform—it’s a cash flow management tool that can transform how you handle vendor relationships and business finances.

If you’re ready to take control of your payments and improve your cash flow, I highly recommend heading over to their official website and getting started: Melio Payments.